I’m reading the late Brian Gaynor’s articles on the activities of the New Zealand government and corporate New Zealand in the early 1990s, especially around the privatisation, and ultimate sale of the BNZ to the National Australia Bank.

Poor management and irresponsible lending

Up until the bank was partially privatised in 1987, with 13% floated on the New Zealand stock exchange at $1.75 per share, the bank had been 100% owned by the government.

Under government control also means responding to the shareholding minister’s of the day, and their political drivers.

While under government control, it had lent money to highly leveraged companies in both New Zealand and Australia during the share market boom pre-1987, culminating in bad debt provisions in the billions in the early 1990s.

Crony capitalism?

Just as the BNZ was sorting its balance sheet out, Gaynor records a range of financially engineered deals involving the BNZ, the government and high profile merchant bankers that had the effect of significantly financially advantaging those parties to the detriment of minority shareholders and the BNZ.

The government and the merchant bankers both ended up highly privately incentivised to sell their interests at what was seen at the time as a very low price, depriving minority shareholders of the value in one of New Zealand’s largest companies.

A lack of constraints on corporate and regulatory behaviour provided no protection to minority shareholders whose investment values plummeted because of financial smoke-and-mirror deals.

Generational Blowback?

The effects of this specific transaction are and will continue to affect generations of New Zealanders, as to date approximately $20-$25 billion of wealth has returned to Australia from this one transaction alone.

Not only did the government selfishly serve its own interests to the detriment of the country, but it agreed to transactions that had the effect of lining the pockets of elite bankers from the “family silver”.

Across all of the banks sold, how much has New Zealand cumulatively lost through failing to capture the value of future profits in the sale price that was realised at the time?

And is this why the government is now looking at the state of competition in the banking industry: i.e seeking to regain value from transactions it now regrets?

And might this channel of “wealth accumulation” be an underlying driver for wanting to nail the High Wealth individuals?

Business Desk Links

Brian’s articles, in order are here:

- Looking back: David Lange, Roger Douglas, Ron Brierley and the BNZ

- Looking back: BNZ Part 2: Rob Campbell, Frank Pearson and the bank

- Looking back: BNZ Part 3: Lindsay Pyne, Michael Fay and the bank

- Looking back: BNZ Part 4: Capital Markets, Fay, Richwhite and the bank

- Looking back: BNZ Part 5: The Winebox company and the bank

- Looking back: BNZ Part 6: The bank adopts Fay, Richwhite proposal

- Looking Back – BNZ Part 7: The final twist – NAB grabs BNZ at a discounted price

The links, text and graphs are used with the kind permission of Business Desk.

Here’s some economic history I’ve found very interesting:

The endgame to the long-running BNZ saga began in earnest on July 21, 1992, when National Australia Bank (NAB) announced a takeover offer at 80 cents per ordinary share and 95 cents for each convertible preference share. This compared with the 70-cents-per-ordinary-share placement to the crown in late 1990 and the issue of convertible preference shares to Fay, Richwhite at 84 cents each. The offer valued the BNZ at $1.5 billion.

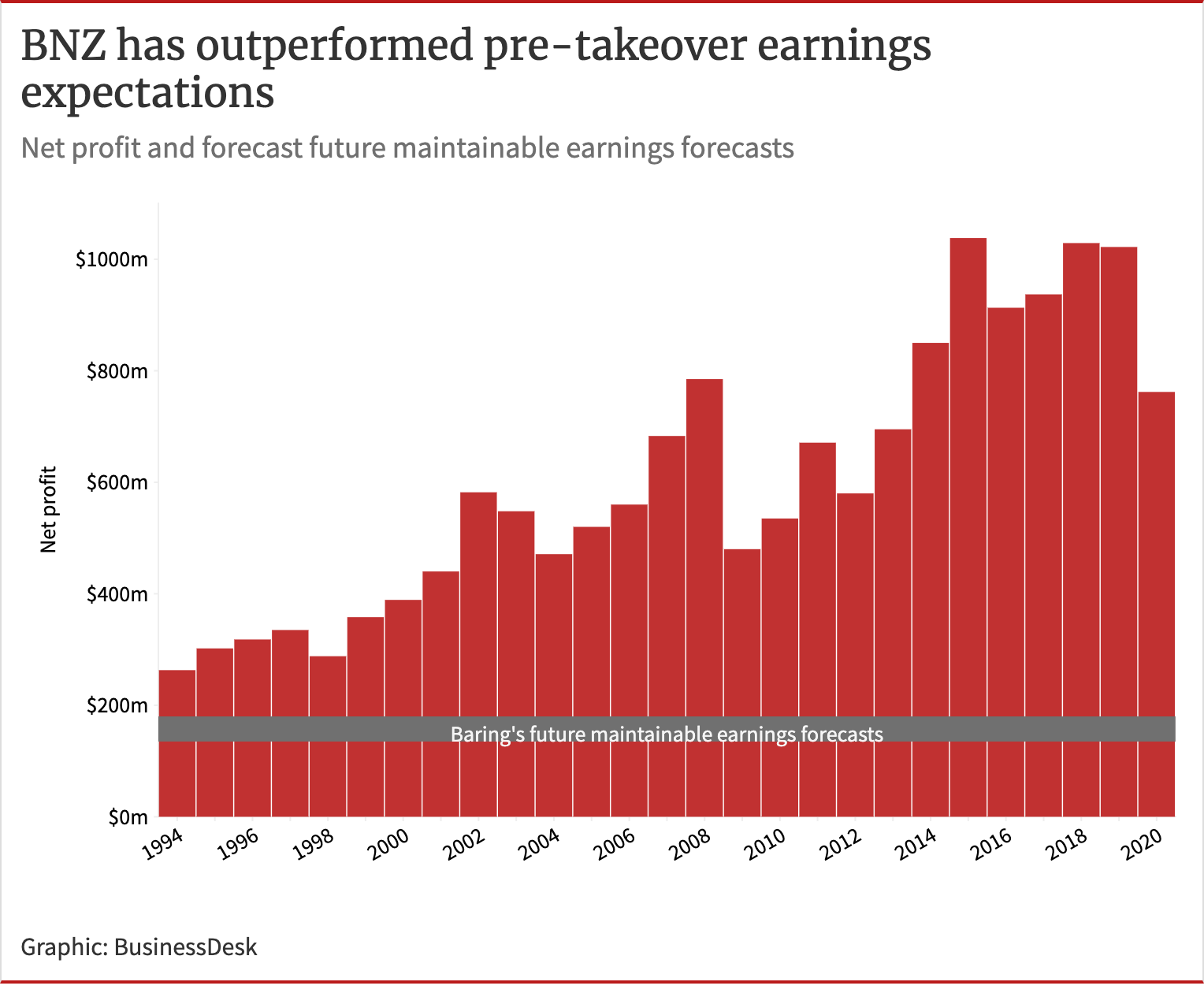

…Baring’s valuation was based mainly on its assessment that the bank’s future maintainable earnings would be between $135m and $180m a year.

…

The following table shows that Baring’s forecasts were far too low; the BNZ’s lowest net-profit-after-tax figure following the NAB acquisition was $263m for the Sept 1994 year. This compared with Baring’s predicted high of $180m.

The BNZ was a fantastic purchase for NAB because the New Zealand bank is probably worth between $15b and $20b at present and the Australian owner has received $10.5b in dividends over the past 28 years.

This represents total value of between $25.5b and $30.5b to NAB, compared with its $1.5b purchase price.

We often refer to the great value created by Port of Tauranga (listed in 1992), Mainfreight (1996) and Ryman Healthcare (1999), but the loss in value through the sale of the BNZ has been greater than the positive contribution made by these three companies.

NAB purchased the BNZ at a discounted price and the acquisition represented a massive transfer of value from New Zealand to Australia over the following three decades.

Ever feel like you’ve been swindled?

Rob Campbell – Banker

Yep, the same guy, was on the board of the BNZ during the late 1980’s. Here he is, second from the left on the first row:

As Gaynor remarks:

The BNZ, which had a historical focus on retail rather than corporate banking, didn’t have a loan examination or reporting and information system that enabled it to accurately evaluate its bad-loan situation. Its bad-debt assessment process was largely discretionary after the Oct 1987 market crash, with the board playing a major role in determining the level of provisioning at the end of a financial period.

Most of its directors had limited banking experience and were essentially plucking figures from thin air, particularly as BNZ management was under-reporting the bank’s bad-loan difficulties in the hope that they would go away. The huge role played by the BNZ board in determining bad-debt provisioning had an inherent drawback, particularly if two or more directors had different perspectives of share and property markets and the bank’s potential losses in these areas.

These different perceptions resulted in a massive clash between Campbell, who had a trade union background, and fellow director Frank Pearson, who was an experienced investment manager with a front-row seat to the New Zealand excesses of the 1980s.

Rob Campbell responds here: https://businessdesk.co.nz/article/opinion/looking-back-on-the-bnz-my-response

Check out Business Desk for this and other great reads