Yeah! Good News! New Zealand’s nailed inflation.

Don’t get me wrong – I dislike inflation, and everything about it. I don’t like how sustained persistent inflation is created by the government spending money it doesn’t have and buying up large on both the taxpayer and consumers ticket (inflation is a tax). I don’t like how it leads to a cost-of-living crisis, and is uneven across commodities, and hits things like houses hard.

I really don’t like the way the Reserve Bank of New Zealand caused our version too. Just like the Reserve Bank of New Zealand knew what would be needed to stop our version.

Monetary policy is lowering inflation by lifting interest rates to ensure persistence in inflation above our inflation target is squeezed out of the economy. We are incredibly determined to get inflation and inflation expectations back to target.

…

Returning inflation to target could be made more difficult if businesses and workers try to push up their real profit margins and real wages to make up for the inflationary impact of the pandemic, the war, and the storms. In this case, monetary policy would need to be more contractionary for longer, resulting in a deeper recession.

But the effects of monetary policy happen to others.

Those who are made unemployed, who’s business close down, who leave the country in record numbers looking for better opportunity, those paying rates, or rent and anything else that is price inelastic (inelastic produces need their prices to increase even more that normal goods in order to reduce their consumption).

Adrian Orr, the RBNZ Governor, is pretty comfy on his fixed salary of $NZ853,810 per annum.

When was Inflation Tamed?

So … if:

- the RBNZ now needs to aggressively contract the economy because thats the medicine against inflation, and

- the RBNZ was the dick outfit who got all “loosey-goosey” with credit and caused inflation in the first place, and

- “other people’s” inflation “expectations” now have to go on the whipping block for something the RBNZ did,

then when did New Zealand win its fight against inflation, through the RBNZ beating the rest of New Zealand up for something it did?

Stats NZ published its CPI metrics on the 16 October 2024, and commentators reckon inflation has been nailed. In anticipation, banks have started dropping lending interest rates.

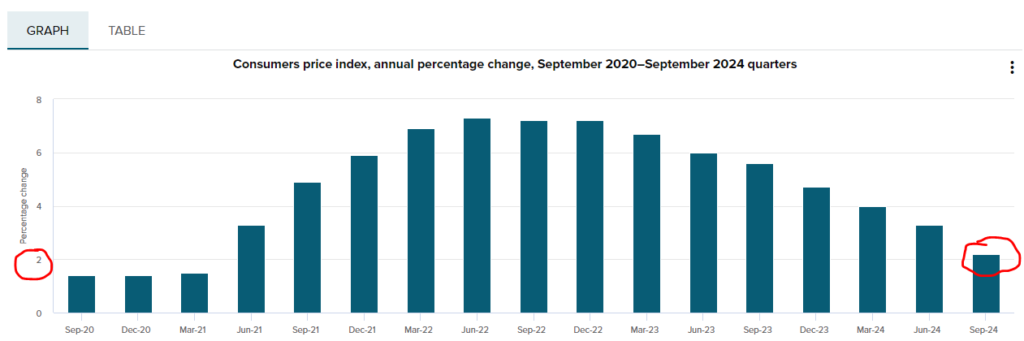

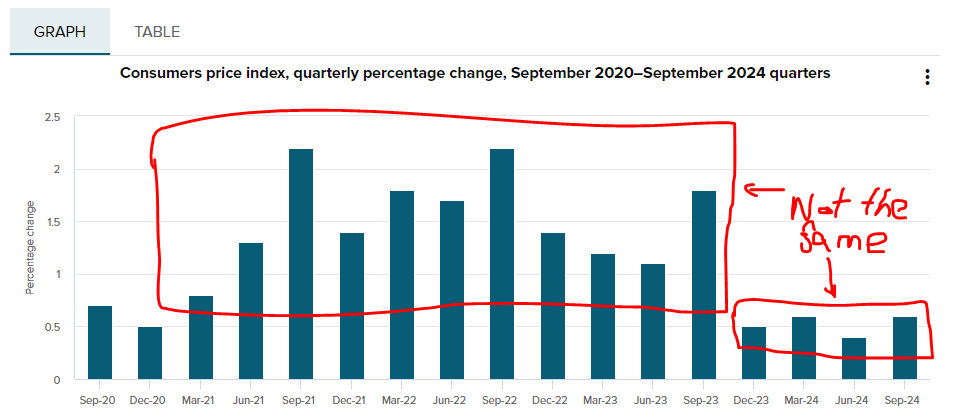

When you look at the actual price statistics (see below), the annual inflation figure only entered the Reserve Bank’s 2% – 3% “price stability” mark in September 2024. But when you look at the quarterly price changes, also below, price inflation has well and truly been muted since December 2023.

The annual figure inherits all of the historical baggage of the inflation period purely and simply through the effects of a rolling historical average that includes measures in the past that cannot be changed. But the quarterly figure, which reflects the state of inflation now shows inflation has been contained since December 2023!.

By looking at the mathematically high annual rolling average figure, the Reserve Bank has kept monetary pressure on too tight for four quarters. All of those unemployment, business failing, people leaving, effects have been imposed on the country for 12 months longer than they needed to be.

How are those inflation “expectations” feeling right now? Do you feel like you suddenly no longer believe prices will increase? Or have you been thinking like that for the last 12 months, while the Reserve Bank of New Zealand has been “squeez[ing you] out of the economy”?

There’s something to be said for the RBNZ making decisions for other people, whilst not having any “skin in the game” itself.

Pingback:For fuck’s sake… – Over the Beer Mug